What Is MSME?

The Ministry of Micro, Small, and Medium Enterprises is the apex executive body for formulation and administration of laws, rules and regulations relating to micro, small and medium enterprises in India. MSME commenced its operations on October 02, 2006 with the aim to facilitate development and competitiveness in micro, small and medium enterprises. The MSME sector contributes to roughly 50% of India’s total export, 45% of India’s full Industrial employment, and 95% of all country industrial units. More than 6000 types of products are manufactured in these industries (As per msme.gov.in). The classification of MSME is based on:

(i) Investment in plant and machinery for businesses involved in manufacturing or production of goods, and

(ii) Investment in equipment for businesses providing services.

Companies in the manufacturing and services industries can both register for obtaining MSME. This registration is not mandatory for businesses, but it is always recommended to get one. This is mainly because this registration comes with many benefits related to loans, taxes, business set up and credit facilities.

What Is The Qualification For Udyam Registration?

All kinds of business types are qualified to acquire the Udyam registration certificate.

- Proprietorship

- Hindu Undivided Family (HUF)

- One Person Company (OPC)

- Partnership firm

- Limited liability partnership (LLP)

- Private limited or limited company

- Co-operative Societies or

- Any association of persons

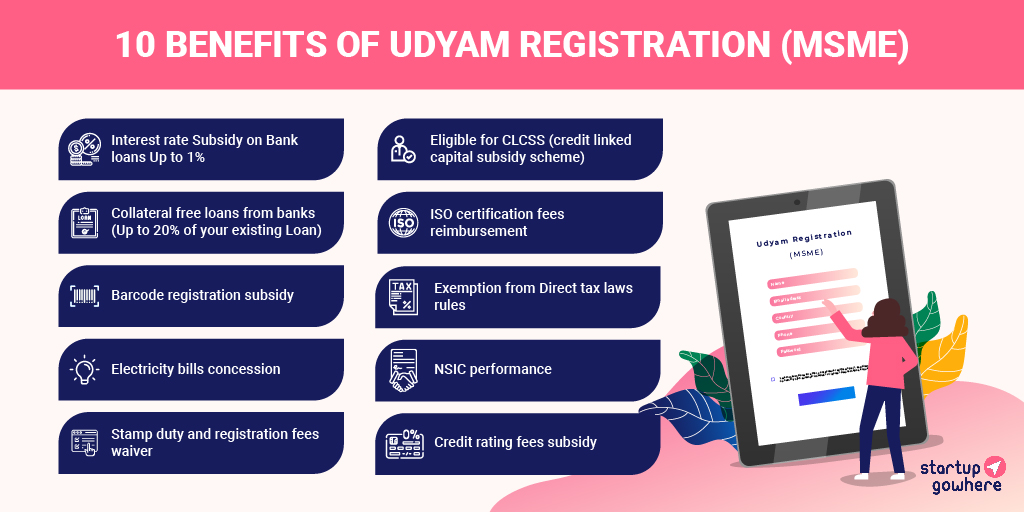

What Are The Benefits Of MSME Registration?

- Interest rate Subsidy on Bank loans: compared to standard loans, the interest rate after MSME is very low at around 1-1.5%

- Collateral free loans from banks (Up to 20% of your existing Loan)

- UDYAM Registered entity gets eligible for CLCSS (credit linked capital subsidy scheme)

- Electricity bills concession

- Stamp duty and registration fees waiver

- Barcode registration subsidy

What Is The New Classification Of Existing MSME?

| sector | criteria | micro | small | medium |

|---|---|---|---|---|

| manufacturing | investment | <Rs.25 lakh | <Rs.5 crore | < Rs.10 crore |

| service | investment | <Rs.10 lakh | <Rs.2 crore | <Rs.5 crore |

Due to the lower limits criteria, businesses are finding it a challenge to grow in this competitive environment. There has been a long overdue request to scale down the boundaries for further expansion of businesses within the MSME limits. Finally, Aatmanirbhar Bharat Abhiyan (ABA) government has ticked a yes to revise the MSME regarding investments and turnover. Moreover, the distinctions between service and manufacturing in the MSME has also been removed from the definition. Below is the revised MSME classification.

| Criteria | Micro | Small | Medium |

|---|---|---|---|

| Investment & Annual turnover. | <Rs.1 crore &

<Rs.5 crore |

<Rs.10 crore &

<Rs.50 crore |

<Rs.50 crore &

<Rs.250 crore |

How To Register For MSME ?

This registration can be done on the government portal. New users can enter their Aadhar card number with or without a pan number. You have to enter the remaining details asked on the page and then generate OTP to procceed further.

The Process We Follow At StartupGoWhere:

- Register your company/Business as an MSME and obtain a UDYAM Number here.

- We ensure you get formal purchase orders and delivery proofs for all orders.

- we mention on all invoices, “XYZ Ltd. is registered under the MSMED Act, 2006. Udyam Number – XXXXXXXXXXXX (Delayed payments beyond 45 days attracts interest at a rate three times of the bank rate notified by RBI)”.

- If a customer delays your payments without any reason, we notify them that you would be approaching the MSME Samadhaan for your pending charges if they do not release the same in X days.

- If they still do not release payment, we file a complaint on MSME Samadhaan’s website; the customer would receive a government notice (like an IT notice) and has to respond with the relevant compliance in the next 15-30 days.

What Are The MSME Schemes Launched By The Government?

Incubation

This scheme provides financial aid to innovative entrepreneurs in evolving their dreams to reality for implementation of their products and designs. The purpose is to promote new techniques, better products, and more productive services.

Quality And Technology Up-Gradation Scheme

This scheme will help MSMEs reduce production costs and adopt a clean development mechanism by using energy-efficient technologies.

Grievance Monitoring System

This scheme helps in terms of complaints, checking the complaint’s status, and opening the complaint if they are not satisfied with their outcome.

Credit Linked Capital Subsidy Scheme

This scheme replaces the old obsolete technology with a new one. Capital subsidies are also provided to the business owners to upgrade their technology.

Solutions Offered By StartupGoWhere?

MSMEs have received a lot of attention from the government regarding regulatory measures, reliefs, and benefits. Consequently, the eligibility criteria and incentives offered to the MSME sector in terms of financing have attracted the attention of businesses across the country.

We hope startupgowhere helped you get the basic knowledge about MSME.