Permanent Account Number (PAN) card is a 10-digit alphanumeric code assigned to every taxpayer in the country. It is an electronic system that stores tax-related information of a company/person.

The Income Tax Department of India issues a pan card.

Table Of Contents

What is Eligibility for PAN card?

What are the types of pan cards in India?

What are the documents required?

How to apply for a PAN card?

How to track the status of a PAN card?

How to edit and update PAN?

What are the do’s and don’ts of Pan card application?

Why is a PAN card necessary?

Benefits of having a PAN card

What is an E-PAN card?

Who can apply for E-PAN?

What are the steps to apply for E-PAN?

Don’t have a PAN card?

Conclusion

What is Eligibility for PAN card?

Under section 139A of the Income Tax Act, the following entities must have a PAN card-

- Any individual who has paid tax or is liable to pay tax (according to income tax slabs)

- Companies that have a yearly turnover of Rs. 5 lakhs in any assessment year

- Importers or Exporters who pay any kind of tax or duties.

- Trusts, charitable organizations and associations.

- Non-Resident Indians or anyone who pays tax in India.

- Any person entering into a financial or economic transaction requires quoting PAN

- A minor will require a PAN card if he/she is a nominee to a property.

What are the types of pan cards in India?

- Individual

- Company

- HUF

- Partnership/ Firm

- Trusts

- Society

- Foreigners

What are the documents required?

Following are the documents required-

- For an Individual:

- Address Proof

- Identity Proof

- For a Company:

- Certificate of Registration issued by Registrar of Companies

- For a HUF:

- Affidavit of the HUF

- Address Proof

- Identity Proof

- For a Partnership/ Firm:

- Certificate of Registration/ Limited Liability Partnerships

- Partnership Deed

- For a Trust:

- Copy of Trust Deed/Certificate of Registration Number

- For a Society:

- Certificate of Registration Number from Registrar of Co-operative Society/Charity Commissioner

- For Foreigners:

- Passport

- Address Proof/ OCI card issued by the Indian Government

- Bank statement of the residential country

- NRE Bank statement in India

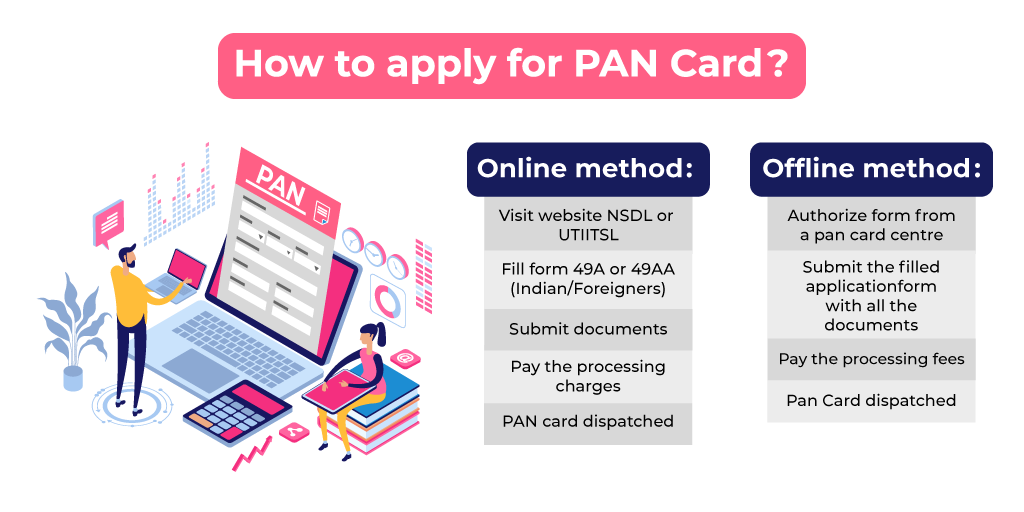

How to apply for a PAN card?

There are 2 ways to apply-

Online method:

- Visit website NSDL or UTIITSL

- Fill form 49A or 49AA (Indian/Foreigners)

- Submit documents

- Pay the processing charges.

- PAN card dispatched.

It usually takes 10-12 working days to receive a PAN card.

Offline method-

- Authorize form from a pan card centre

- Submit the filled application form with all the documents

- Pay the processing fees.

- Pan Card dispatched.

How to track the status of a PAN card?

To track your pan card, click on track card here.

Read: How To Choose Between Private Limited Company & LLP?

How to edit and update PAN?

PAN can be edited and updated in 2 simple steps-

- Visit the NSDL website and click on the update PAN option.

- Then select “correction” in existing Pan information.

What are the do’s and don’ts of Pan card application?

| Do’s | Don’ts |

|---|---|

| Details to be filled in capital letters. | Don’t miss filling any blanks to fill. |

| Attach only required documents | Do not apply for a new card if it is lost or stolen. You can apply for a duplicate pan card |

| Provide current and working mobile number | Do not pin or staple the photograph. |

| Mention correct ZIP code in the address field. | Do not provide address proof/identity proof which is not in the name of the applicant. |

| Submit recent colour photographs (size 3.5 cm X 2.5 cm). |

Do not abbreviate your name. |

Why is a PAN card necessary?

- All the taxpayers need to provide a pan number for paying income tax.

- It is needed when establishing a business.

- A lot of critical financial transactions require pan information.

Benefits of having a PAN card-

It assists in the following-

- IT Returns Filing

- Identity Proof

- Opening a Bank Account

- Purchase or Sale of Goods and Services

- Bank Drafts, Pay Orders and Banker’s Cheque.

What is an E-PAN card?

E-PAN is a valid proof of PAN. It is a digitally signed PAN card issued in electronic format by the Income Tax Department using Aadhaar e-KYC.

E-PAN has a QR code that possesses demographic details of PAN card holders. E-PAN is available for those PAN holders who have a valid aadhar number and have a mobile number registered with aadhar. The whole process is free and done online. It is also important to note that this service is available for a limited time and it is issued on first- come- first- serve basis.

Who can apply for E-PAN?

You should meet the following criteria to apply for e-pan-

- You shouldn’t have a PAN already.

- You should have an Aadhar card.

- You should be an indian resident.

- You should be an individual taxpayer and not a HUF or a company.

- Your current phone number should be linked to your aadhar card

What are the steps to apply for E-PAN?

- Click on the link to to apply for new PAN

- Select either of the 2 options:

- Both physical PAN and E-PAN

- E-PAN only and not physical card..

The E-PAN will be issued on your email id. And the physical card is delivered to your address.

- Submit details as per your aadhar card

- 15 digit acknowledgement number will be sent to your email/phone number.

Don’t have a PAN card?

If your income is eligible to fall under the tax bracket, you must have a pan card and pay taxes.

In case you don’t have one, then 30% of taxes are charged on your income and wealth by the Income Tax Department. This applies to individuals, companies, and other entities responsible for paying taxes in the country.

Conclusion:

Availing a pan card is now a hassle-free process. You can talk to our experts if you have any more doubts!